According to Nationwide’s study “The Fear of Financial Planning,” 58% of millennials, more than any other generation, turn first to websites for financial planning resources.

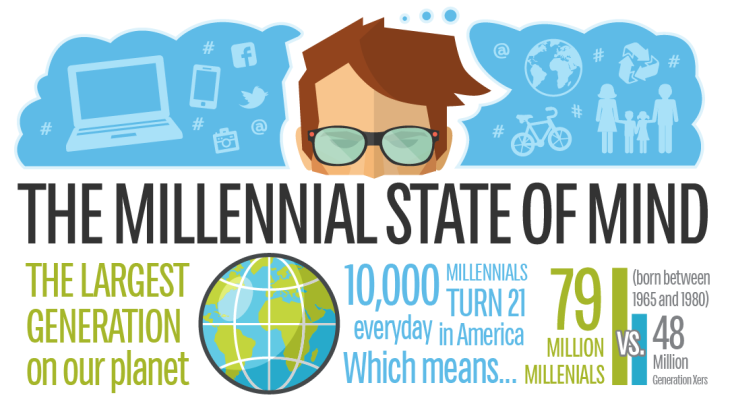

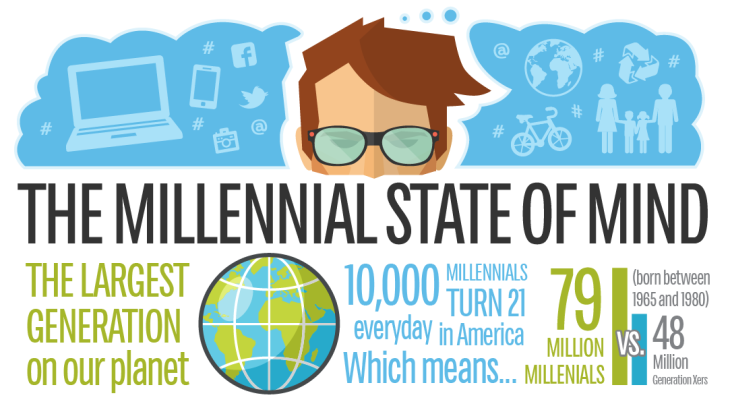

So, how do you and will you need to market to Boomers, X’ers, and Millennials?

Make sure to read our blog here on how to develop content for Boomers, Gen X’s and the Millennials, and then review these 3 challenges wealth manager’s face:

..1. Advice is virtual. In today’s world, it is hard to find an industry that has not been revolutionized by digital technology. According to a report by EY, “after the financial crisis and the resulting loss of clients’ trust in established financial services institutions, digital technology firms began to emerge with fresh ideas on investing and providing advice. While traditional wealth management firms were focused on meeting new regulatory requirements and the complexities of crisis-driven consolidation, the start-ups saw an opportunity to leverage their hightech talent to build out simpler and cheaper methods of delivering financial advice in an innovative way.” These companies are called digital registered investment advisors (RIAs). They provide simplified financial solutions through websites and online platforms, reducing the need for face-to-face interaction, which is trending among millennials who are on the go, tech savvy, and want their financial information on their digital devices – to review at their leisure and convenience.

.

Thus, wealth managers need to develop a more flexible wealth management services platform to accommodate self-management through online tools.

.

“We do things on our schedule, from our phones with the push of a button, and we absolutely demand affordability.” — Alexa von Tobel, Gen Y founder of LearnVest, as quoted in “The Recession Generation: How Millennials Are Changing Money Management Forever.”

.

2. Changing values. Millennials don’t want their lives to revolve around money. They refuse to compromise family and personal values as well. They give value to companies and employers who act socially responsible and they remember past economic and financial crisis. The financial crisis made millennials cautious and conservative regarding financial matters. In general, millennials live with an innovative spirit and this can limit the amount of risk they are willing to take with their investments, and heightens their sense of social responsibility (i.e. “values-based investing” (VBI) or “impact philanthropy”). Values are important to note and understand when speaking and communicating information and advice to your clients.

.

Online investment communities, charitable giving strategies, online crowd funding, or local sustainability projects could be activities that appeal to the affluent millennial.

.

3. Transparency is non-negotiable. The financial crisis also made millennials more skeptic of financial institutions and thus they demand transparency in all interactions. Hidden agendas will not be tolerated. All fees need to be clearly stated and reasonable. Millennials have much higher expectations regarding communication and transparency.

.

Click here for more continued reading (in-depth 8-page PDF from Deloitte) on Millennials and Wealth Management: Trends and Challenges of the new Clientele.

.

As you know, millennials are growing to become the largest population segment by 2020. Compliance is no longer an excuse to avoid these trends, it’s time to learn and get used to what the growing market wants and needs.

.

This blog was written by our staff writers. If you are looking for a solid digital marketing strategy, contact us today for a free consultation, we are here to help! Follow @cogomojo on Twitter, the COGO Interactive Company Page on LinkedIn, and subscribe to our blog, for more tips and resources. Thank you for reading! Your support is very much appreciated.